The FHSA: The key to your new home

Backgrounder: New for 2023

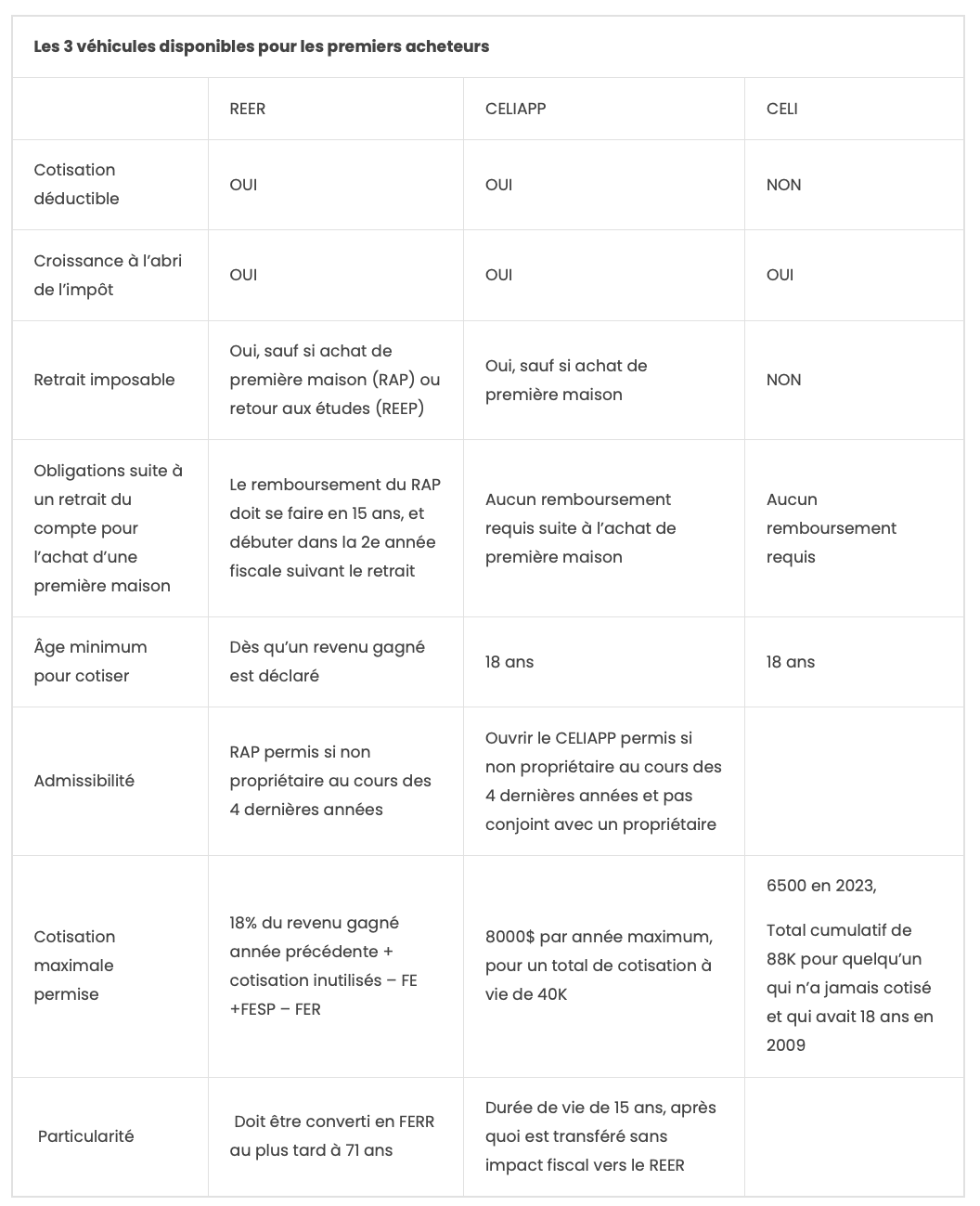

What is an FHSA? FHSA stands for Tax-free First Home Savings Account. Launched in 2023, this new tool is designed to make accessing home ownership for first-time buyers easier. As we’ve seen for some time now, average house prices have risen sharply, and the FHSA was created to enhance the HBP (Home Buyers’ Plan) program, which already allows Canadians to withdraw, $35,000 from their RRSPs for the purchase of a first home with no tax repercussions. Governments have tried to help first-time buyers get their down payment together earlier, and the FHSA helps them do that. In this article, we’ll explore this new account launched by the federal government.

How does the FHSA work?

An FHSA is a cross between two accounts you’re probably familiar with: the RRSP and the TFSA. The new FHSA combines the best of both accounts.

Between an RRSP, TFSA, and TFSA, how do I know which account to use?

As a first-time home buyer, the ideal would be to maximize all three accounts. But not everyone might have the cash assets to be able to maximize all three.

What do I prioritize, and in what order? Below are a few examples:

- If you don’t have enough in your emergency fund, prioritize contributing to a TFSA to build that security.

- If you have enough in your emergency fund, and you have a savings capacity of less than $8,000/year to purchase a home, make your TFSA a priority, rather than an RRSP.

- If you have enough in your emergency fund, and you have a savings capacity of more than $8,000/year, first maximize the FHSA by $8,000, then contribute the excess amount to your RRSP.

- If you have enough in your emergency fund, and you already have $35,000 or more in RRSPs, make the $8,000 contribution to the FHSA a priority, then contribute the excess amount to your TFSA.

- If you have more than $35,000 in your RRSP, but no additional savings capacity, consider transferring up to a maximum of $8,000 from your RRSP to your TFSA.

Contributions

As soon as the account is opened, your contribution room will begin to accumulate. You may contribute $8,000 per year, to a maximum of $40,000. But the maximum contribution limit doesn’t work exactly like the limit for the TFSA, or the RRSP. Once the account has been opened, unused contribution room may only be used if it occurred within the past year. But, if you don’t open an account in 2023, your total contribution room will drop from $16,000 to $8000, for 2024.

To learn more about this account, or to find out how to use it in your specific situation, please contact one of our advisors.

Subscribe to our newsletter

Autres articles

Categories

- Financial planner (1)

- First home (4)

- Home (4)

- Investments (1)

- News (6)

- Retirement (6)